Factor Sales analyses NGK precious metal spark plugs

Factor Sales investigates Niterra’s greener NGK precious metal spark plugs, and their significant impact on motor factor revenue.

Since their introduction to the UK automotive aftermarket in 2018, precious metal spark plugs have had a growing impact on motor factor revenue. In fact, in August 2023, Niterra’s NGK precious metal spark plugs accounted for more than half the revenue of all spark plugs sold in the UK!

The range is evolving too: in June 2023, Niterra introduced nine new part numbers, further extending its car parc coverage.

We delve into the sales performance of Niterra’s precious metal spark plugs, with commentary from Becca Knight, Niterra UK marketing manager, all using Factor Sales’ aftermarket data.

Why opt for a precious metal spark plug?

Precious metal spark plugs, like Niterra UK’s NGK Laser Iridium and Platinum ranges, are more efficient, last longer, and are better for the planet than their traditional Nickel counterparts. It all comes down to the greater melting points and relative hardness of the precious metals. Hotter electrode temperatures result in greater electrical efficiency and better wear characteristics.

Niterra precious metal spark plugs are making a mark in the aftermarket.

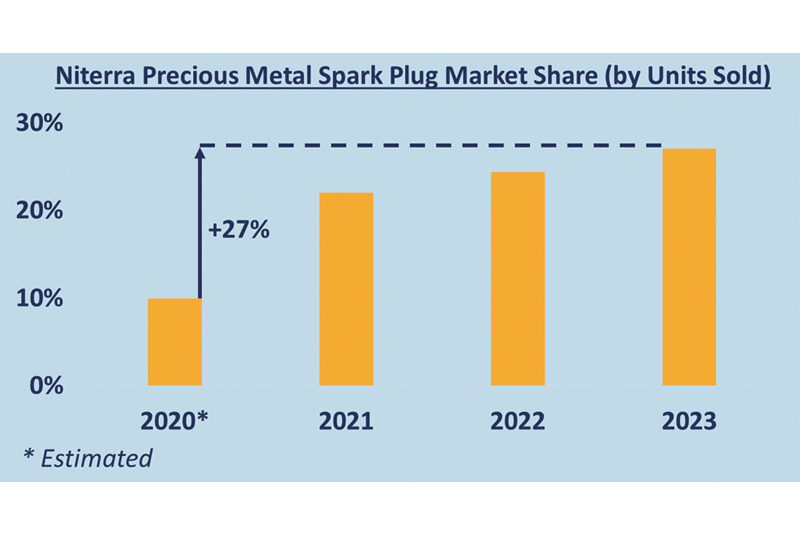

Niterra’s market share of its precious metal spark plug lines has increased from ~10% of all units sold in 2020, to 27% in 2023 (Figure 1, below). And with precious metal spark plugs selling at nearly three times more than Nickel alternatives, Niterra’s precious metal lines now account for a whopping 50% of motor factor spark plug revenues in the aftermarket (as of August 2023.)

Becca notes that by monitoring sales trends and growth closely through Factor Sales’ data insights dashboards, Niterra has been able create an ambitious but attainable growth strategy:

“We’re delighted that our customers are reaping the rewards from precious metal spark plugs. Using Factor Sales, we can see how this new technology has had a very successful start in the UK and continues to gain share of spark plug market opportunity.”

The clear upwards trend in quarterly sales volumes for Niterra precious metal spark plugs highlights their growing popularity in the marketplace; however, like many aftermarket parts, they experience significant seasonal fluctuations (Figure 2, below).

Monitoring these fluctuations with Factor Sales has allowed the team to accurately forecast Niterra sales.

Becca continues: “Seasonality is a challenge because it is changing. Seasonal workshop demands still exist, but they are morphing from just winter and new vehicle registration time into new patterns and trends. Forecasting using Factor Sales’ visual data tools helps us stay ahead, which is especially important while we understand what ‘new seasonality’ looks like.”

Are precious metal spark plugs becoming more affordable?

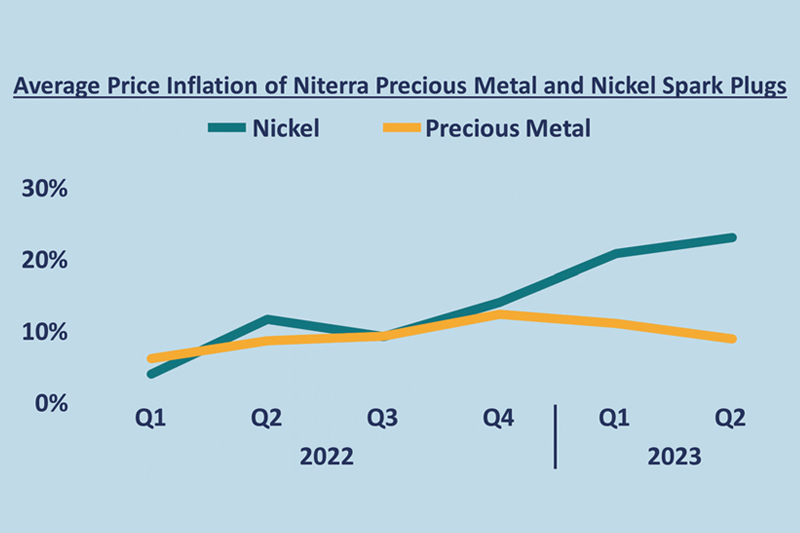

One historical criticism of precious metal spark plugs has been that they are less affordable than their Nickel counterparts. Whilst it’s true that back in spring 2021, Niterra precious metal spark plugs cost, on average, 3.3 times as much as their Nickel counterparts, Factor Sales can report that by Q2 of 2023, that had fallen to 2.8 times.

In fact, Factor Sales can show that inflation of precious metal spark plugs has been lower than that of Nickel for the last year (Figure 3, below) in 2023, which is great news for consumers. It’s also positive news for the environment, as more consumers will be able to opt for more sustainable spark plugs.

Becca says: “Pricing in the current climate is tough; everyone is experiencing the same inflationary pressures. What’s clear is that precious metal spark plugs are the right technology in the right application today, and they are worth workshops making the choice to fit them specifically.”

Factor Sales, powered by Pearson Ham Group, monitors transactional data from almost 40% of motor factor branches in the UK. Through scaling up this data, Factor Sales generates an accurate view of the automotive aftermarket.