Factor-Sales returns to demonstrate how COVID-19 has affected key product categories in the UK aftermarket, with the pandemic resulting in some startling results.

The tables below are based on sales transactions and credit notes collected daily from over 800 motor factor sites.

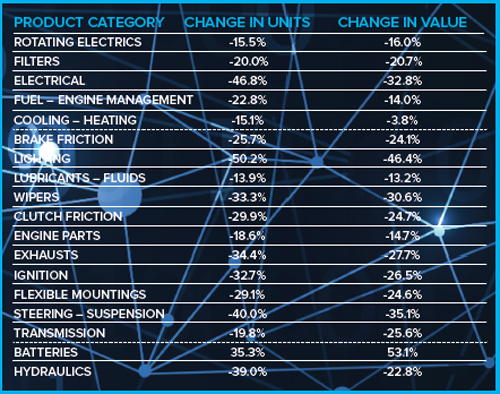

The numbers from the second quarter’s last four weeks, when compared to the same period last year, show a slightly more encouraging picture than the last quarter of the year to date. Of course, the reports have been run at Product Category level, but the Factor-Sales data splits it down to Sub Category and Sub-Sub Category where necessary. So, for example, Brake Friction Discs are up 4.9% in units and 8.6% in value, whereas Pads are only up 2.3% in units and 3.7% in value.

COVID-19 has certainly had the anticipated impact on the industry, as many garages closed. However, recent government statistics show that well over 90% are open again and, with the MOT requirement coming back from 1st August, we will undoubtedly see further good news.

Of course, vehicles with a six month exemption will still carry that, but they will gradually be brought back in and many will need to be made roadworthy.

If the system isn’t sufficiently monitored to ensure that motorists comply, this might cause problems. On top of this, we simply don’t know whether some families will decide that they can do without a second car, as working from home has proven to be perfectly viable for many.

Throughout the pandemic, the big news story has clearly been the battery market; in what is traditionally a slow period of the year for battery manufacturers, demand has surged.

This is a result of vehicles being left idle for too long and consequently failing to start on demand, with the battery simply running down.

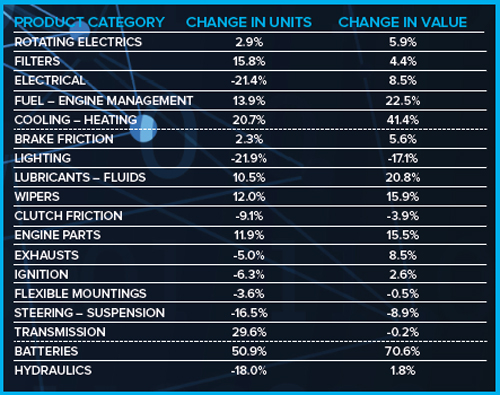

Comparing net sales from factors to garages in the second quarter of 2020 with the same period in 2019:

Comparing net sales from factors to garages in the last four weeks of the second quarter of 2020 with the same period in 2019: