Factor Sales investigates aftermarket product growth

Analyst Ben Thomson reveals what the fastest growing and declining products are in the aftermarket.

Government regulation, seasonality and even international conflict are all affecting revenues, volumes, and prices. To maximise revenues, you should monitor sales trends to identify areas of product growth or decline. Focus on stocking the correct product groups, with the right suppliers and support customers through the constant change in the aftermarket.

The bestselling 5% of products account for 90% of a typical factor’s sales revenue. We have ranked the fastest growing and declining product groups by year-on-year sales revenue, from reporting factors. We have analysed the percentage change in sales revenue and percentage change in quantity/units sold – and there are clear winners and losers.

Our top takeaways:

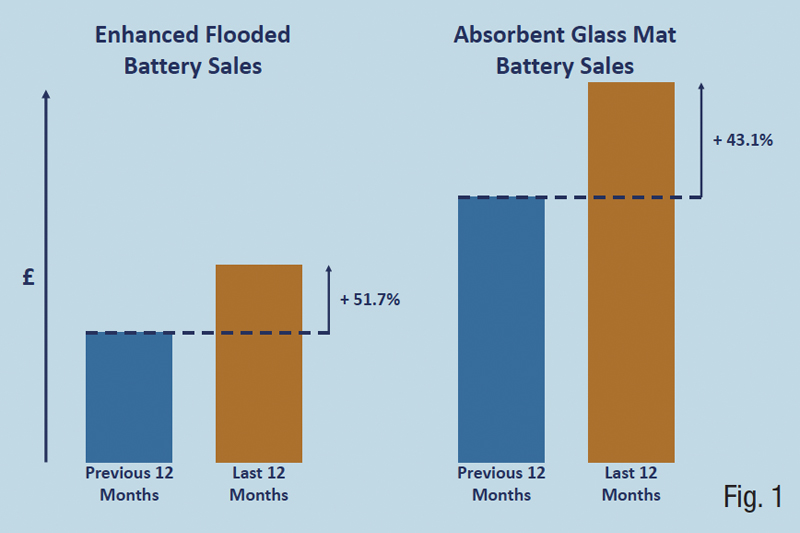

Battery revenue growth. Enhanced Flooded Batteries (EFBs) experienced a 52% revenue growth in the last 12 months, while Absorbent Glass Mat Batteries had 44% revenue growth, two of the highest growth rates in the market (Fig 1)! Both were driven mainly by huge volume growth, with prices increasing marginally in comparison. Reasons behind increasing demand are not fully understood, though, some argue that extreme temperatures in summer 2022 caused batteries to deteriorate faster. Regardless, the demand means there is an opportunity for you to increase prices to capture even more value from the unseasonal demand.

Higher energy input costs continue to impact the aftermarket.

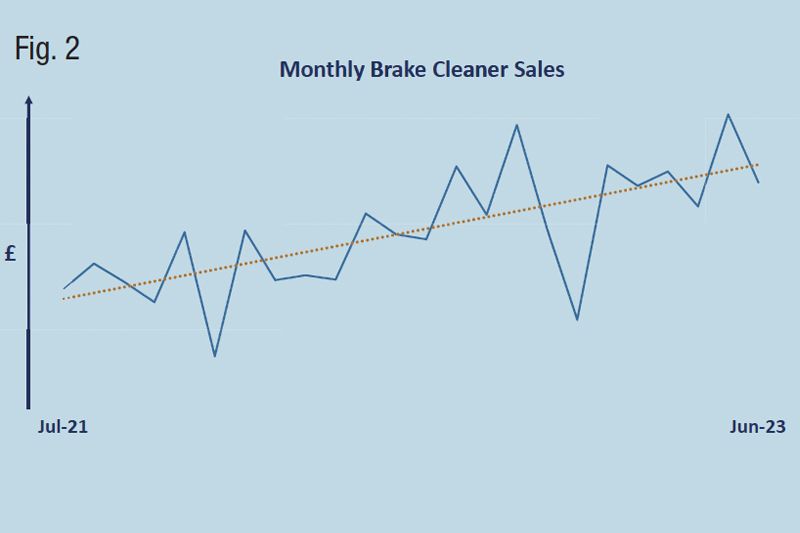

What do brake cleaner, AdBlue and synthetic engine oils have in common? They are manufactured, in part, using natural gas. Prices rose exponentially over the last 18 months. This has had a knock-on effect on the aforementioned products, which are always in high demand for ICE vehicles. We have observed a substantial sales increase, with brake cleaner unit growth rising by 6.9% but a huge 35.3% in revenue growth (Fig 2). This can be explained by the increase in prices; however, it is important that you do not develop a reliance on these increased revenues as the international situation is volatile. Natural gas prices are already back to pre-war levels. We will continue to track whether the indirect benefits of the new lower norm in natural gas feed through to aftermarket parts pricing. The first supplier to reduce prices on the back of lower natural gas costs could create sizeable demand advantages.

Changing customer habits pose a problem for motor factors.

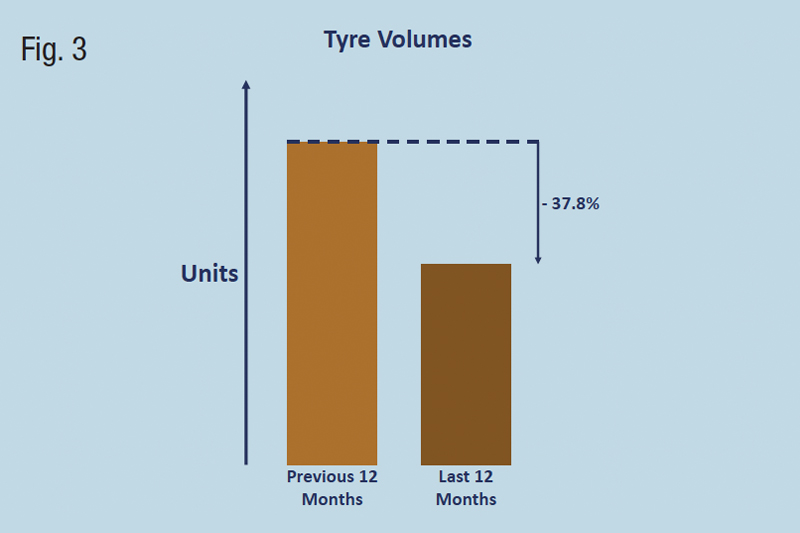

Significant tyre sales and volume decline will be a cause for concern and is a trend being observed across Europe. Tyre durability has improved significantly in the past 10 years. Driving habits have also changed – more people are working remotely – average yearly driving mileage has fallen significantly below pre-pandemic levels (24% lower according to By Miles). The cost-of-living crisis may also lead to drivers neglecting to replace worn tyres.

These factors are impacting the aftermarket: tyres are lasting longer and people driving less, so demand for tyres has fallen considerably, with year-on-year sales volumes down 38% (Fig 3). You should consider diversification to focus on tyres that increase car economy and carry sustainability messaging to realise value from changing consumer demand.

The headlight sector also suffered a decline. Newer LED headlights are becoming increasing common, and these are sealed units that are more expensive to repair and less susceptible to failure. This is reflected in an almost 20% decrease in volumes, whilst the average selling price for headlights is up 19%, highlighting the move to more expensive products. You should find a balance between decreasing volumes and increasing prices to maintain revenue and profit margin.

Declining caravan usage is having an impact.

The camping and caravanning industry boomed in the second half of the COVID-19 pandemic, with international travel difficult and holidaymakers turning to ‘staycations’. This produced immediate sales opportunities in 2021, with related markets, like propane gas refills, also benefiting.

Conclusion

The automotive aftermarket is always changing; relying on historical performance to predict future trends is not enough. Use Factor Sales to gain a competitive advantage and ensure your business thrives. If you would like to hear more about growth in the marketplace or see the data behind the article, then scan the QR code below or email us at automotive@pearsonhamgroup.com