What does lower inflation of EV+ICE parts mean?

Recent data and analysis from Factor Sales, a market measurement data provider that allows motor factors to capitalise on transactional data, market share and trends within the industry, has revealed a noteworthy fact: a continued overall downward trend within the aftermarket sector. While this may initially seem concerning, a closer examination unveils a positive narrative of adaptability and competitiveness within the market.

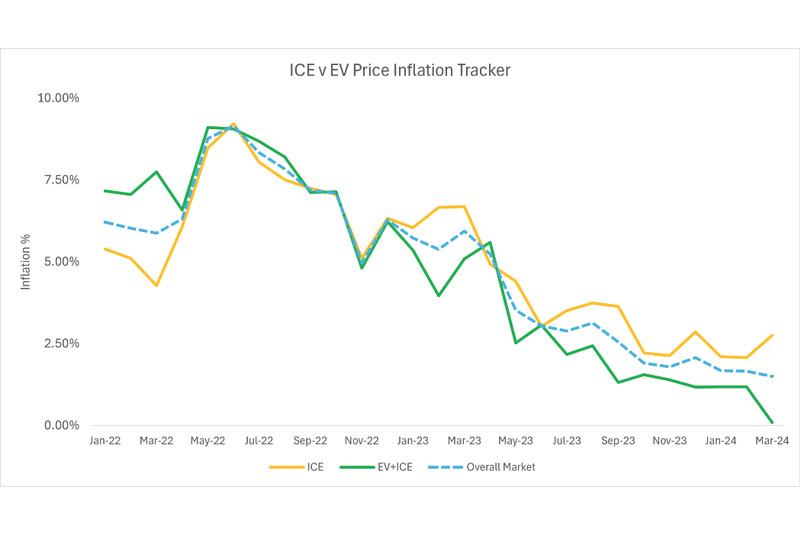

One observation is the discrepancy in inflation rates between parts for internal combustion engine (ICE) powertrain parts versus EV+ICE parts. Despite the overall downward trend, ICE-only parts persist at a higher inflation rate compared to their EV+ICE counterparts. This trend has continued for over 12 months and indicates a significant shift in market dynamics.

For EV owners, this discrepancy in inflation rates brings promising news. The fact that EV+ICE parts’ inflation has remained consistently lower than ICE-only parts suggests a growing acceptance and adaptation to EVs within the aftermarket. This could be attributed to several factors contributing to the rise of EVs in the automotive market.

One plausible explanation is the increasing consumer demand for EVs; in February this year, the Society of Motor Manufacturers and Traders announced that the one millionth battery electric vehicle (BEV) had reached the UK’s roads. Furthermore, albeit on a global scale, the world’s bestselling car was electric; Jato’s data suggested history was made when it was revealed the most popular new car across the planet is the Tesla Model Y – selling more than 1.2 million in 2023.

As more EVs enter the market, the demand for aftermarket parts tailored to these vehicles naturally grows. Factor Sales believes the surge in demand for EV-compatible parts could have contributed to the relative stability of inflation rates within the EV+ICE segment.

Moreover, advancements in EV technology and infrastructure may have bolstered consumer confidence in EVs; according to Zapmap’s latest data, at the end of January 2024, there were more than 55,000 EV charging points across the UK and over 30,000 charging locations – this marks a 46% increase in the total number of charging devices since 2023. The government, upon reacting to this figure, is confident of reaching its target of 300,000 public charge points by 2030.

As EVs become more mainstream, aftermarket businesses are compelled to adapt their offerings to cater to this evolving consumer base. Consequently, Factor Sales argues that this adaptation may lead to increased competition and efficiency within the aftermarket, contributing to the overall downward trend in pricing.

Furthermore, regulatory initiatives aimed at promoting clean energy and reducing carbon emissions have incentivised both consumers and manufacturers to embrace electric mobility. In response to these regulatory pressures, manufacturers and suppliers selling into the aftermarket are investing in research and development to produce more affordable and sustainable EV-compatible parts, thus driving down costs within the EV+ICE segment.

Conclusion

While the downward trend in the aftermarket may raise concerns for some stakeholders, it ultimately reflects the resilience and adaptability of the market in response to changing consumer preferences and technological advancements. The persistently lower inflation rates in the EV+ICE segment underline the growing impact and influence of EVs and the industry’s readiness to embrace this shift.

Factor Sales’ own data and analysis highlighting the downward trend in the aftermarket industry offers a nuanced perspective on the market’s state of play. Rather than representing a decline, this trend signifies a period of transformation and innovation within the sector.

Ultimately, as EVs continue to gain traction, aftermarket businesses have a unique opportunity to capitalise on this shift by adapting their offerings and embracing the new but always evolving landscape.

Contact Factor Sales today!

Factor Sales offers invaluable insights and analysis to help industry professionals navigate market trends, including the growing influence of EVs.

Don’t be left behind! Join Factor Sales today to stay ahead of industry shifts and capitalise on emerging opportunities.