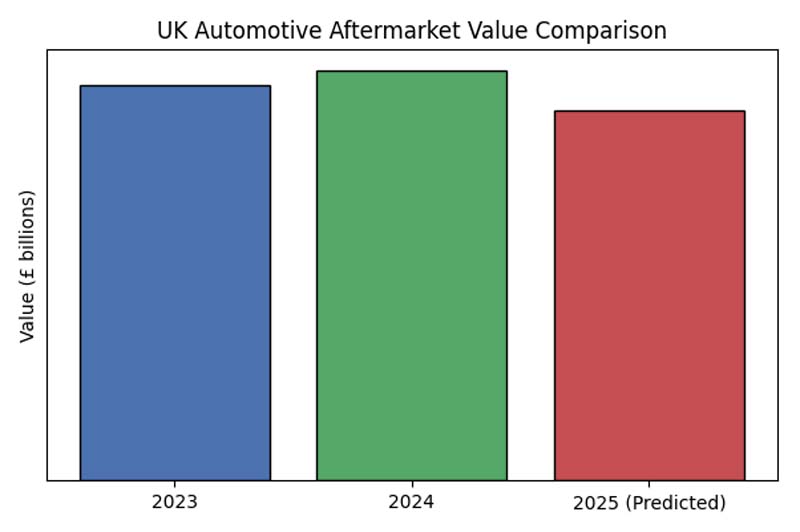

Three years of change in the UK aftermarket

As we approach the close of 2025, Factor Sales Business Development Manager, Sebastian de Pedro, takes a deep dive into the fortunes of the UK automotive aftermarket to understand how the sector has evolved over the last three years.

The report includes 2023 and 2024 in full, as well as January to October 2025, with predictions for November and December based on current market trends and historical data.

The headline for 2025 is clear: both unit sales and overall value have fallen significantly. Unlike previous years, pricing adjustments have not been enough to compensate for reduced volumes, meaning the market has contracted in real terms.

- Units: Down by around 9% compared to 2024

- Value: Down by approximately 9% year-on-year

- Declines were consistent across quarters, with Q2 seeing the steepest drop.

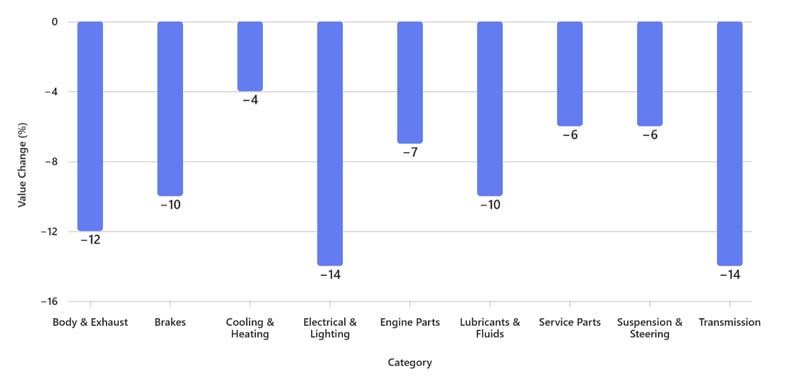

Category performance under the microscope

Our analysis of value trends across the 10 major categories reveals a clear shift between 2024 and the predicted full-year 2025:

- Electrical & Lighting: Biggest drop – about 14% after small growth last year

- Transmission: Down 14%, reversing strong gains in 2024

- Body & Exhaust: Fell around 12%, flat in 2024

- Brakes and Lubricants: Both down around 10%, signalling weaker demand

- Engine Parts and Service Parts: Declines of about 7% and 6%, respectively after moderate growth

- Suspension & Steering: Down 6%, while Cooling & Heating is most resilient with a drop of just 4%

Key takeaway: Categories that surged in 2024 are now seeing sharp reversals, while essential maintenance areas remain relatively stable.

Looking ahead

With Q4 historically contributing a smaller share of annual sales and early indicators pointing to continued pressure, 2026 will require:

- Data-driven decisions for inventory and promotions

- Closer collaboration between factors, suppliers and workshops to manage cost pressures

- Focus on categories showing stability, such as Cooling & Heating and Engine Parts

However, there is reason for optimism: GiPA’s October 2025 industry report, citing DVSA forecasts, suggests December 2025 could see a 29% increase in vehicles requiring MOTs compared to the same month in 2019 – and, importantly, a 7% increase over December 2024. This surge could provide a welcome boost to aftermarket demand as the year closes.

Factor Sales remains committed to being a trusted partner for aftermarket intelligence. Our genuine transactional data goes beyond the numbers, turning insights into strategies that drive success for motor factors, suppliers, retailers and workshops in a rapidly evolving market.