Factor Sales reports ongoing market struggles

In its latest article, Factor Sales, the leading market measurement provider that converts genuine transactional data from 60% of motor factors in the UK into tangible benefits for both distributors and suppliers, goes back to basics – explaining what the platform is designed to achieve and provide for its loyal factors – plus reveals if the market has picked up from a slow start to the year.

The purpose of Factor Sales is to provide its network of motor factor subscribers with authentic, exact data insights that can strengthen and optimise their businesses – giving them an edge in a competitive market.

How does Factor Sales achieve this? By partnering with point-of-sale providers, like MAM Software, to receive end-of-day sales figures, those figures are anonymised, standardised into category hierarchies and used to generate national aftermarket benchmarks.

Those benchmarks are pricing, return rates and bestselling lines – all pivotal dynamics of a successful factor business – and, intriguingly, all can be compared against fellow branches of multi-site businesses.

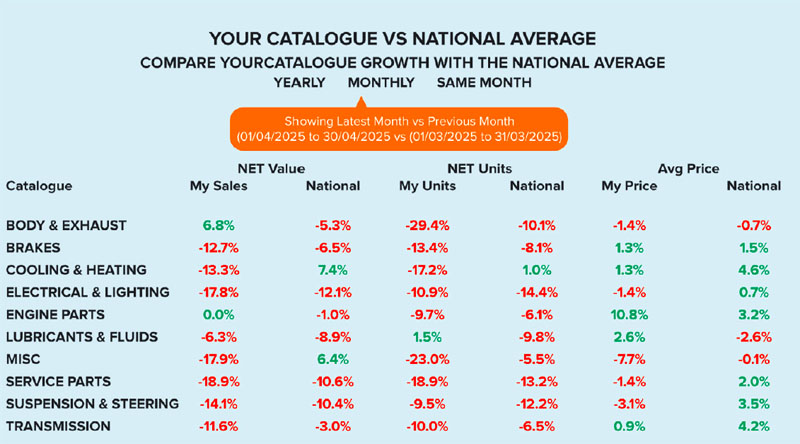

Factor Sales allows its factor users to be proactive by displaying notable figures, like if categories or lines are underperforming in comparison to the national or branch average.

The data is then neatly packaged into free monthly snapshots and sent to a factor’s inbox (example above). These can show month-on-month analyses, year-onyear comparisons and same month last year benchmarks.

Ultimately, Factor Sales removes the guesswork and delivers noticeable benefits.

After Factor Sales revealed that the trade had faced a sticky start to 2025 – the first nine weeks showed year-on-year sales and value down by 3.1% and 3% respectively – it is disappointed to announce that the struggle has continued.

The first 22 weeks of the year, when

compared with 2024 trading numbers, saw a 5.82% drop in revenue and 4.83% in units sold. Compared to the same period in 2023, the unit decline is smaller at 2.16%, and revenue is broadly flat with a slight 0.03% increase.

The disparity between revenue and units sold reflects an increase in average prices across the automotive aftermarket. The average value of a single part has risen to £21.01, up from £20.12 in 2024 and £19.36 in 2023.

This increase is driven by stronger sales in higher-value categories, such as body and exhaust components, alongside a decline in lower-value miscellaneous items. These shifts are offsetting the pricing pressures brought by national factor chains engaged in discounting strategies.

Despite the struggles, Factor Sales can report that the cooling and heating category continues to go from strength-to-strength, both engine and service part components have picked up from the start of the year and have closed the gap to parity – standing at 1.5% and 1.3% down respectively when assessing revenue. The former posted a 2% growth in units.

Meanwhile, braking continues to underperform and is currently 9.5% down in monetary terms and 11% in units sold.