How did the weather shape the industry in 2024?

According to the Met Office, the UK experienced its coolest summer since 2015. Rainfall levels were around average, with some regional variation, while sunshine was also deemed “average” – but did these cooler temperatures impact the automotive aftermarket, and does weather correlate with sales? Factor Sales investigates.

Before diving into the 2024 figures, it’s worth considering the summer temperatures of 2023 and 2022. In 2023, the UK saw record-breaking hot temperatures in June, making it one of the warmest summers on record. The previous year, 2022, was even hotter – England recorded its joint hottest summer ever!

These warmer conditions correlated with consumer demand, especially for summer-related products, like air conditioning and car washing paraphernalia.

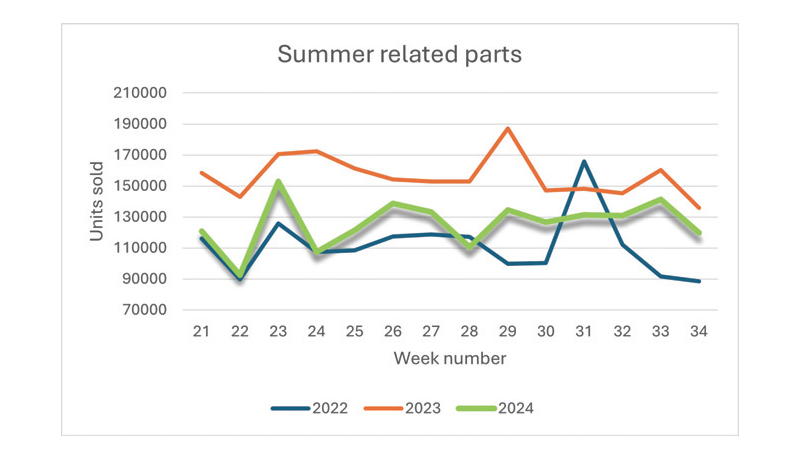

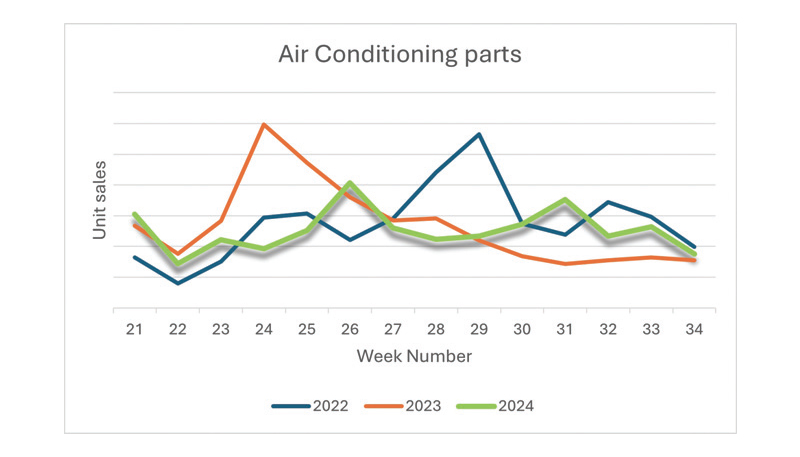

However, 2024 tells a different story with data collected between weeks 21-34 (end of May to August). The summer holidays correlated with a shift in purchasing behaviours across typically summer-related items, like air conditioning, camping equipment and car cleaning products. While both 2022 and 2023 showed a clear spike in demand during this period, possibly driven by the heatwaves and summer holidays, 2024 saw no such surge.

This raises some questions: Are consumers now opting for overseas holidays, moving away from staycations, as post-COVID travel restrictions ease? Or could the cooler, less favourable weather be deterring people from domestic travel and, consequently, reducing demand for seasonal automotive products?

According to a report in The Guardian, it claimed that holiday-let owners reported a “significant fall” in bookings, with the sector feeling the effects of the cost of living, an increasingly saturated market and poor weather.

According to Office for National Statistics, in 2023, there were 55.5 million holiday trips made abroad by UK residents. This is marginally down on pre-COVID levels (58.6 million) but is significantly higher than 2022 (45.6 million).

The figures and information suggest that weather patterns and the return of international travel are impacting consumer behaviour. Supporting this hypothesis is the decline in sales of air conditioning products. With fewer hot days in 2024, demand for these products waned significantly compared to the previous two years.

H1 2024: A resilient start

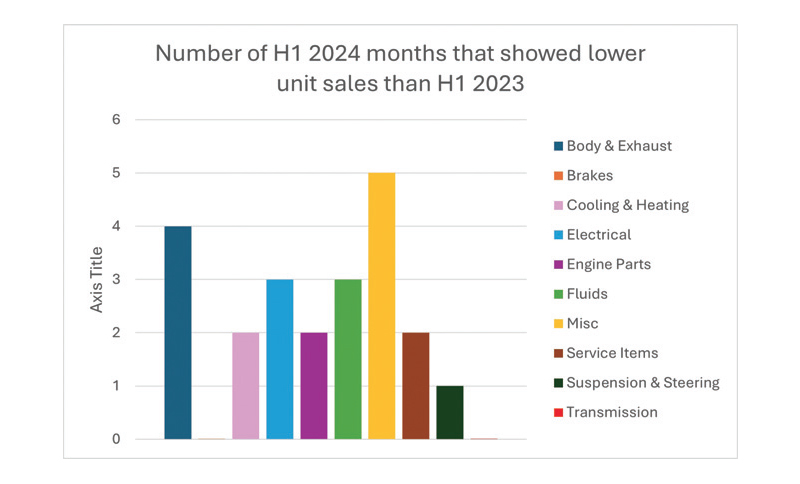

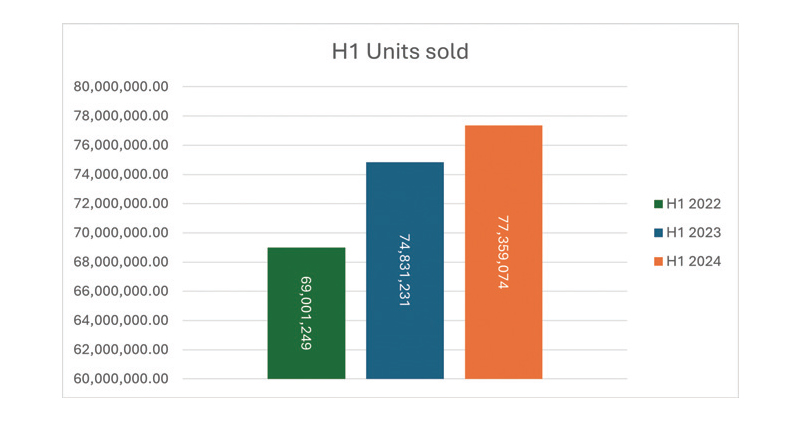

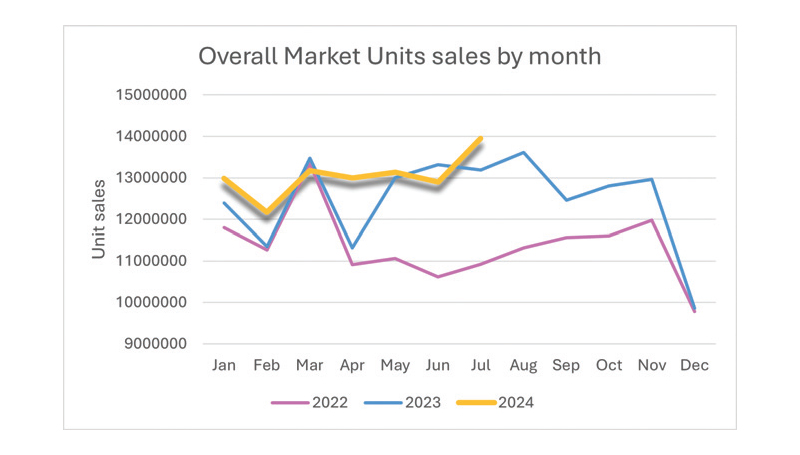

While Factor Sales has reported its findings for summer, it has also used its transactional data from participating motor factors to look back at the first half of 2024. Its data showed the automotive aftermarket remains resilient, with overall sales holding strong; however, this is largely due to specific product segments performing well. The market has experienced notable volatility in certain product areas.

Body & Exhaust and Miscellaneous categories have had a particularly challenging time compared to 2023. On the other hand, Braking and Transmission have continued to show consistent year-on-year growth, month after month, which has helped support the market’s overall performance.

Despite these ups and downs, H1 2024 has outperformed the same period in 2023 by 3.4%. This growth supports the argument of resilience and adaptability of the aftermarket, even in a cooler summer.

Looking ahead: What to expect in H2 2024

Typically, the aftermarket sees one MOT season outperform the other, a trend supported by data from the last two years. Interestingly, Q2 2024 was unusually steady, which suggests the second half of the year could see a slowdown in sales.

As we push into the latter half of the year, staying flexible and responsive to these evolving trends will be crucial for motor factors and suppliers alike.