Richard Walkden, Director at Capricorn Car Parts, discusses why the company decided to utilise MAM’s Autocat software to help with its distribution of Facet products.

Capricorn Car Parts is an automotive parts distributor based in Birmingham. The company’s primary brands are Facet Srl – for ignition, engine management and cooling parts – and Borg Warner – for fan drives, blades, and assemblies.

Distribution for Facet began in 2000, and from the offset, we quickly realized that as Facet produced more technologically-based parts, we faced the grey area of competitor product interchanges coupled with very specific vehicle enquiries from our customers.

In response, Facet in Italy got its data on Tec-Doc and from a web-based application guide. From this point, we were left looking at the MAM system as a purely UK-based online data provider. As the company already served both factors and the large buying groups, we deemed it as essential to get on board, and so we paid for our Facet data to go live around 2010.

By late 2017, we were advised that our data on MAM was being phased out to comply with the software company’s new ‘makes and models’ indexing. Why then, in 2021, are we going live with MAM? Well, COVID-19 aside, there was a shift in Facet’s position regarding support, and the pros simply outweighed the cons. Nigel Clemett at Autocat helped us every step of the way, and we eventually agreed to his proposal.

Trade Shows and specific advertising will always have their place in our industry, but both are hard to appraise in terms of ROI, so we reviewed a market with ever more complex parts being produced and a prevalence of increasingly influential buying groups, and concluded the best way to combat both would be to re-look at MAM.

With buying groups only able to offer tenders every two to four years, we questioned how a specialist supplier could get their data and new products in front of their members and then the branch managers and decision makers. For us, the only option was to choose Autocat.

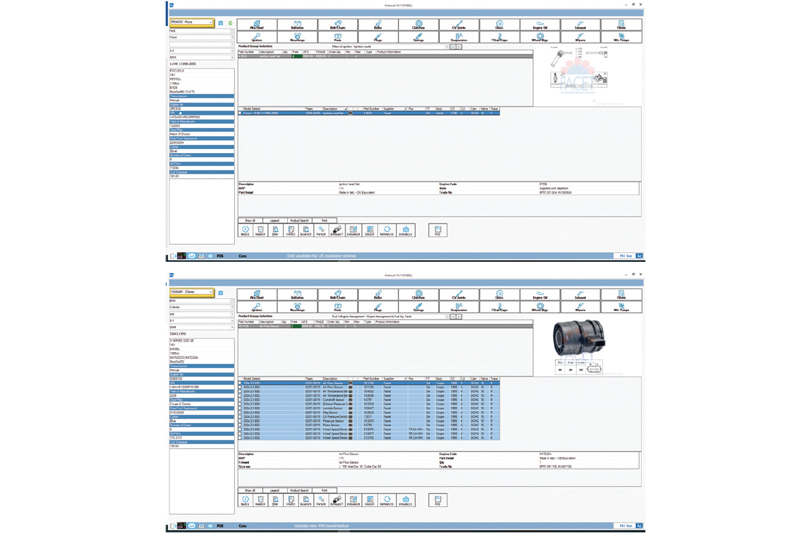

Its ‘vehicle registration’ allied to its engine code-related Makes & Models index really helps counter staff and, more importantly for us, minimises ‘wrong fit’ returns. Furthermore, as long as a branch/depot has Facet switched on as a ‘supplier option’, our full range – including quarterly new releases – will appear for order.

For those larger companies that log ‘lost sales’, a review of these can often draw a buyer’s attention to our products, especially where it’s OE only. We also now offer an aftermarket version.

Our hope is that these individual elements should not only highlight our ranges, potentially adding extra items to stock orders, but they may illicit more enquiries for our products and could progressively bring us to the attention of the buying group purchasing managers, giving weight to us being considered for future tenders or specific stocking plans.

This three-year investment is a key step in promoting the Facet brand. From here, we will eagerly gauge its efficacy and hopefully benefit from Autocat’s data management.

Initial comments from Liz Adams in Customer Services are positive: ‘We are already getting dormant clients enquiring, and the response from existing ones now that we are fully live on MAM has been very strong indeed’