Factor-Sales’ Ian Penny reports on the state of the aftermarket over the course of the first quarter of 2021.

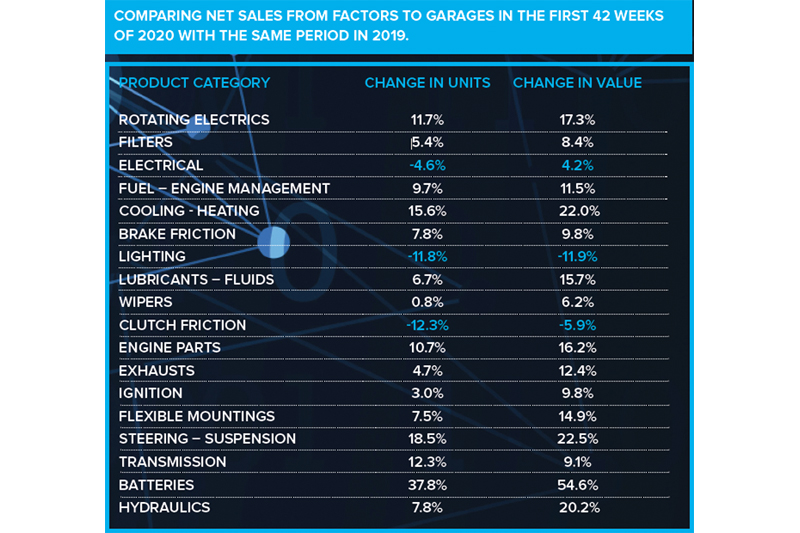

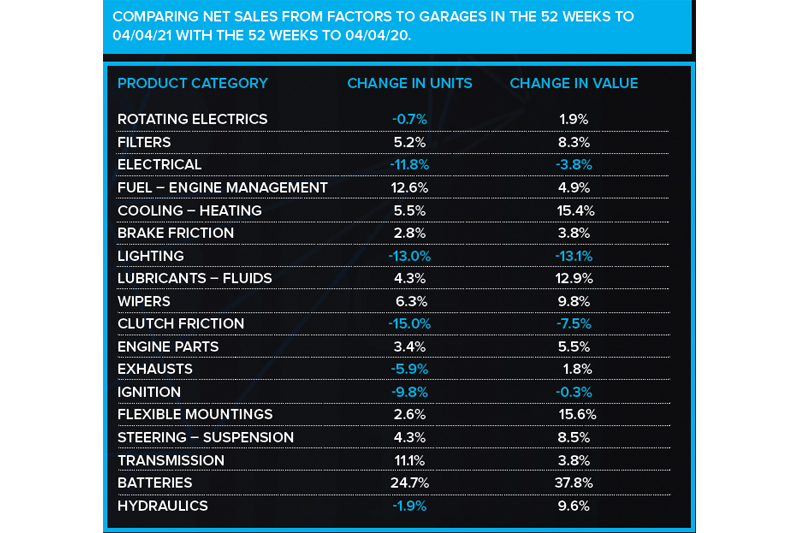

Factor-Sales’ data has been used to review the value/unit trends that measure key product categories in the UK aftermarket. The tables below are based on sales transactions and credit notes collected daily from over 800 motor factor sites.

So it’s been more than a year since we were first put into lockdown, with much of that time spent off of the road. My car has done around 10% of its normal annual mileage, as the ubiquitous Zoom replaced the joy of meeting customers face-to-face. Although it’s considerably more time efficient, there’s definitely not as much fun to be had.

My wife’s car was taken to the local independent garage for the first time, so we were able to specify the make of parts we wanted to be used, and the aftermarket gained a new customer. I have to say that they did a good job and they will definitely see the car again for any service or repair requirements. Good service, quality parts, with the work completed in a timely fashion and at a pleasingly competitive price. Long may it continue!

As the charts show, there has been and continues to be a wide variation between the performance of differing product categories. Having said that, most have enjoyed a solid start to the year when compared to 2020, with one or two showing exceptional growth. For almost all, the turnover performance shows a better result than the units, which reflects increasing costs that are likely to continue in the months ahead.

Brexit has had an impact and shipping costs have increased considerably. Could this possibly be an opportunity to turn the UK into a manufacturing nation once again? Yes, but only if the Government really gets behind industrial output with a package of incentives. A relatively short term investment could produce significant long term benefits for the country.

The overall market for the first 13 weeks of 2021 shows an increase in value of 13.5% over 2020 as some factors continue to report record turnovers. However, with the increased costs, those factors may not be enjoying as significant an improvement in profitability.

There is still opportunity out there for the aftermarket as the MOT process hasn’t caught up yet, and that is largely business for the independent. Add that to the uncertainty around new car sales and the future should be viewed optimistically; as owners keep vehicles a bit longer, the aftermarket benefits. If, like my wife, they get good service at a good price from a local independent garage, they will return.