Factor-Sales is back to round off 2020 with an encapsulating overview of the year’s available aftermarket data.

With 2020 being riddled with uncertainty on both a personal and business level, how have the events that have unfolded – namely the COVID-19 pandemic and the uncertainty over Britain’s position in Europe – affected the independent aftermarket? This is the place to find out.

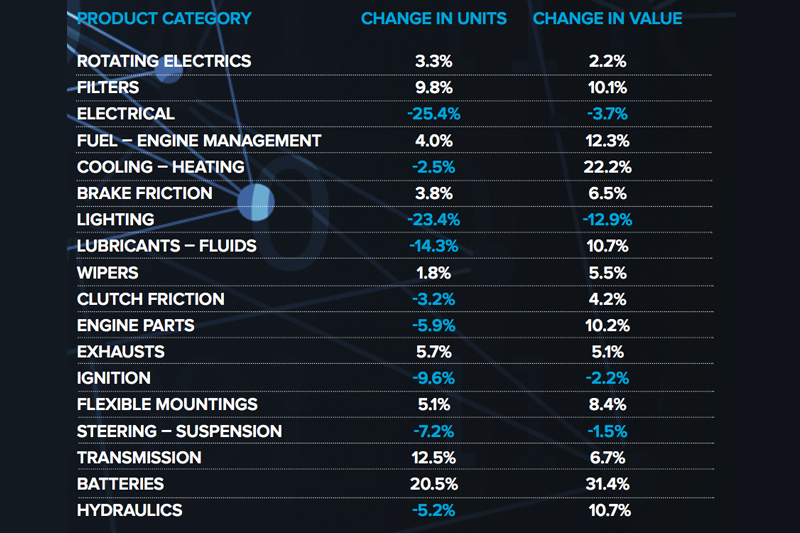

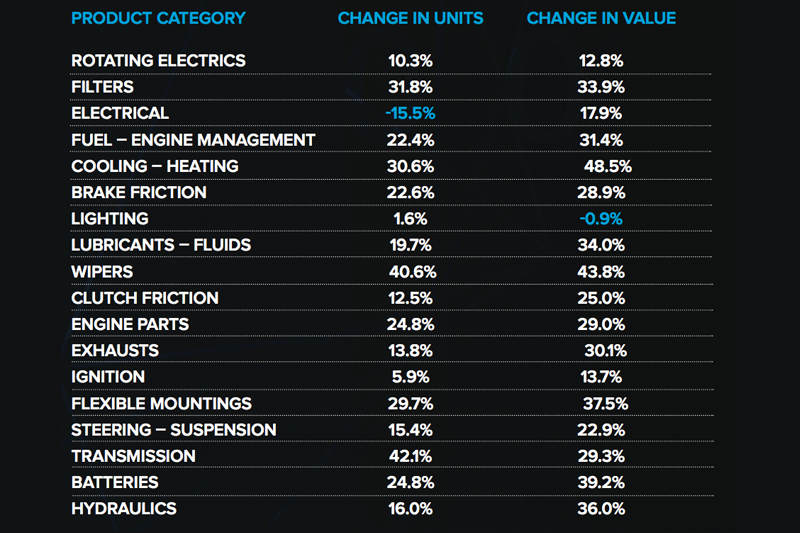

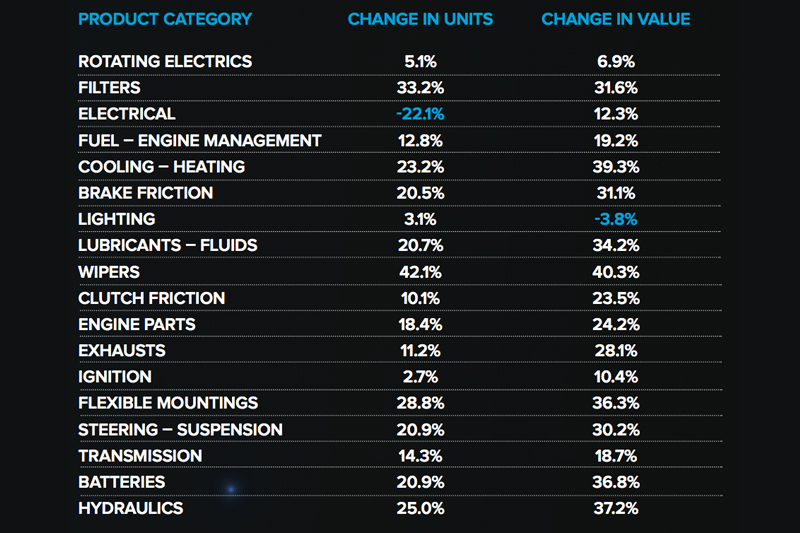

The following data represents a review of the value/unit trends that measure key product categories in the UK aftermarket. These tables are based on sales transactions and credit notes collected daily from over 800 motor factor sites.

Amazingly, the aftermarket has not only survived the COVID-19 scare, but the numbers suggest that, in some key product categories, it has actually thrived, with many factors reporting record sales. This serves up some unexpected but nevertheless excellent news.

The overall market for the first 42 weeks of 2020 shows an increase in value of 8.3% relative to 2019. Of course, as the year-to-date chart shows, price increases have generally improved the market position, which may mean that sales values are up, although this not be reflected in increased profitability.

As we know, the early part of the lockdown period was largely responsible for reductions, as the market dropped to a third of its ‘normal’ level. However, since the reintroduction of the MOT, the numbers for the latest 13 weeks show significant increases compared to last year, and the most recent four weeks have sustained that growth.

This seems to be a reflection of the SMMT’s report of a 33% reduction in new car sales so far this year. With owners not replacing their vehicle, they have a choice to make for servicing, and many will have moved to the independent aftermarket. Is this a simple tightening of the financial belt, or a recognition of the availability of a quality service at a competitive price? Either way, it offers a significant opportunity for the aftermarket to get it right and convince the motorist that the independent has an excellent value for money offering.

To take full advantage of this opportunity, it is vitally important that the supplier, the factor and the garage work together to provide the motorist with excellent service and an excellent product at a fair price.

With a second wave rolling over large parts of the country and a second lockdown having been recently implemented at the time of writing, we are not in the clear yet, and Factor- Sales will report again at the end of the first quarter of 2021. In the meantime, users of the company’s service can track events and pricing down to individual part number level, every day, every week and every month.