In October 2019, Kerridge Commercial Systems (KCS) acquired MAM Software. PMF caught up with James Mitchell, Managing Director for KCS in the UK and Ireland, for an exclusive interview to find out more about the acquisition and what it means for MAM Software’s aftermarket customers.

Q. Please introduce yourself to our readers.

James Mitchell (JM): My career at Kerridge Computer Company (KCC) started as a programmer back in 1994, after graduating from university with a degree in Business and Computer Science. I worked in the R&D side of KCC for a year and a half, before moving into business consultancy, and then product management.

I joined KCC on the motor trade side of the business – KCC created Dealer Management Systems software for significant parts of the global franchised automotive industry (dealerships and vehicle manufacturers). Over the course of 20 years, I have had significant experience of the automotive industry, and I have a strong understanding of the market and OEM-franchised dealers.

KCC was acquired by ADP in 2005; in 2010, ADP divested the Commercial division, thus creating the new company, Kerridge Commercial Systems (KCS). In February 2019, I was appointed Managing Director of KCS for the UK and Ireland.

Q. How did KCS get involved in the automotive industry?

JM: KCS already had a strong presence in the central warehousing, distribution and trade shops for several large UK automotive businesses, including Euro Car Parts and FPS. KCS’ ERP platform, K8, works extremely well for these business, and is particularly successful in running highly business-critical, ‘just in time’ warehouses, and very fast, high volume point of sale areas.

The MAM acquisition has given KCS some great new products and a larger customer base in the automotive non- franchised dealer and workshops sectors, complementing the existing product portfolio.

There’s no overlap with this acquisition, as MAM are really strong with their parts factor catalogue, ERP software and workshop business software. KCS has a deep bank of knowledge in the automotive sector, but what we didn’t have prior to the acquisition was catalogue technology for the independent parts factors.

Q. In which direction do you intend to take MAM Software following the acquisition?

JM: KCS is on a significant and exciting growth phase in the UK at the moment, and the acquisition of MAM Software is the latest stage in this journey. As far as we’re concerned, it’s business as usual. We have ongoing plans to grow and provide ERP and business management solutions. Through this acquisition, KCS is gaining significant expertise in the automotive parts aftermarket.

MAM customers will now benefit from KCS’s extensive number of developers, which have the ability to create software across various vertical industries. There’s also the added advantage of being part of a larger organisation, which brings the security of the wider group and the opportunity for new products to be introduced into their market.

Q. How will the acquisition affect current users of MAM Software products?

JM: Existing development road maps will continue as before, and will be maintained and supported.

Through the acquisition of MAM, we will be able to provide greater scope to the products available to the automotive aftermarket. We want to add greater functionality and value to our customers’ solutions, which will enable them to succeed, win business and increase profits.

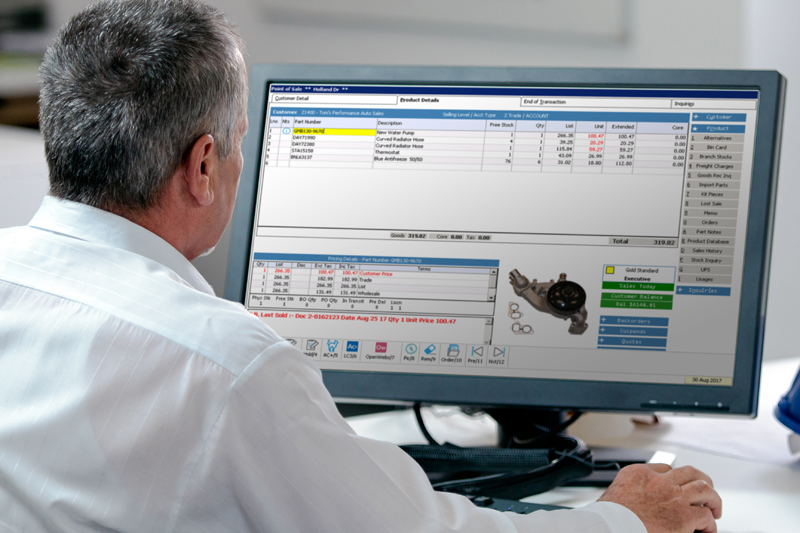

We are particularly impressed with MAM’s product portfolio – particularly the Autocat catalogue and Make Model Index – and specifically the value they bring to customers in terms of a joined up, end-to- end solution for the UK parts factors business. The factor can use their Autopart solution to search for parts in the Autocat catalogue, enabling them to locate the correct part for their customer’s vehicle first time.

Q. Do you foresee any drastic changes to these products in light of the recent change in ownership?

JM: We expect to grow MAM Software by investing in its existing products, and identifying opportunities to offer KCS solutions to its customer base. KCS is focused on providing a long-term product strategy that best serves the market and its customers – and MAM products will be essential in making this happen.

There are various tools we have developed for builders’ merchants – such as electronic point of sale delivery – which we can now pick up and overlay on the Autopart platform. This will give MAM customers extra products that haven’t previously been developed, while enhancing our expertise in being able to provide aftermarket parts and services solutions.

Our aim is to give customers access to a broad portfolio of products, alongside the stability, continuity and strategy that KCS has to offer.

Q. Are there any plans to build upon MAM’s previous relationships with its motor factor customers?

JM: The enlarged KCS Group is now financially stronger and, with the input of a much larger team, we will be able to grow and support a wider motor factor customer base.

Motor factors are now working with a company with greater technological capability. We want to work closely with buying groups and trade groups.